Dive into the Complexities of Jumbo Reverse Mortgage

As the populace ages, financial arrangements for retirement turn into an undeniably significant part of people’s lives. For some seniors, their home addresses a significant piece of their total assets. Jumbo reverse mortgages have arisen as a remarkable monetary device intended to assist property holders with opening the value in high-esteem properties, offering an option in contrast to conventional reverse mortgages. In this article, we will dive into the complexities of Jumbo Reverse Mortgages Lenders California, investigating their advantages, contemplations, and how they contrast from standard reverse mortgages.

Figuring out Jumbo Reverse Mortgages:

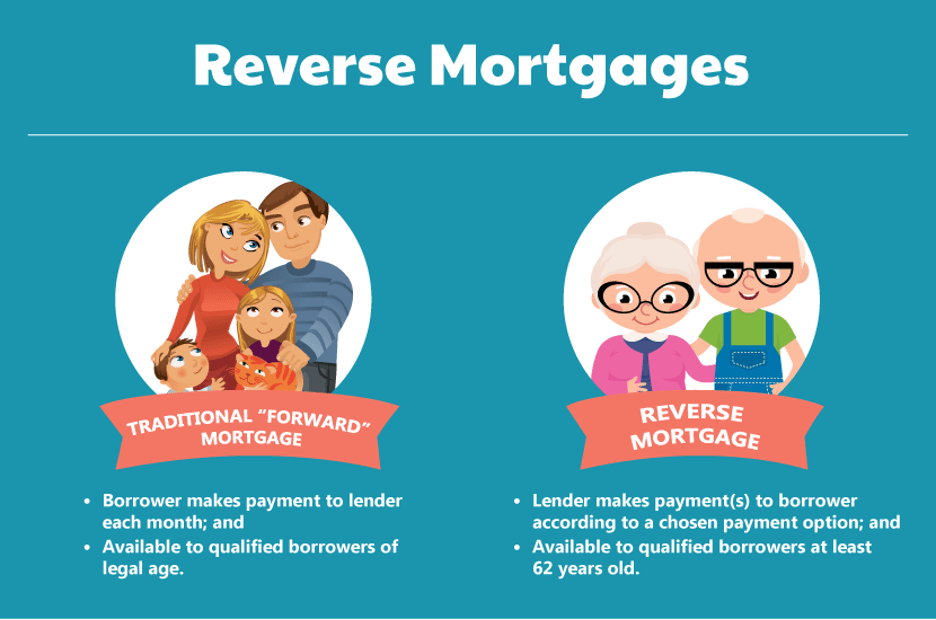

A jumbo reverse mortgage is basically a reverse mortgage that surpasses the governmentally settled credit limit for conventional Home Value Change Mortgages (HECMs). While HECMs are covered at a specific cutoff (which might change every year), jumbo reverse mortgages take care of property holders with higher-esteemed properties that surpass these cutoff points. This monetary item permits qualified seniors to change over a part of their home value into credit continues, furnishing them with extra income, disposing of mortgage installments, and improving their monetary adaptability during retirement.

Advantages of Jumbo Reverse Mortgages:

Higher Advance Cutoff points:

Jumbo reverse mortgages take special care of property holders with high-esteem properties, outperforming as far as possible forced on standard reverse mortgages, frequently known as Home Value Transformation Mortgages (HECMs). This higher credit limit is especially profitable for people dwelling in upscale homes, as it permits them to get to a more huge piece of their home value. The capacity to take advantage of a bigger total furnishes seniors with expanded monetary adaptability, empowering them to address different monetary necessities during their retirement.

Adaptable Payout Choices:

One of the vital advantages of jumbo reverse mortgages is the variety of payout choices accessible to borrowers. Not at all like conventional mortgages that might have fixed terms, jumbo reverse mortgages offer adaptability in how property holders accept their assets. Borrowers can decide on a single amount installment, get a credit extension, pick fixed regularly scheduled installments, or even consolidate these choices to make a customized payout structure. This adaptability engages seniors to adjust the mortgage continues with their particular monetary objectives, whether it be subsidizing home enhancements, covering medical services costs, or supporting other way of life needs.

No Month to month Mortgage Installments:

Like standard reverse mortgages, jumbo reverse mortgages lighten the weight of month to month mortgage installments for property holders. This is a huge help, particularly for retired folks on fixed livelihoods, as it disposes of a significant repeating cost. Without the commitment to make regularly scheduled installments, seniors can divert their pay towards other fundamental everyday costs, sporting exercises, or in any event, constructing a monetary pad for unforeseen expenses. This shortfall of regularly scheduled installments improves the general income for retired folks, adding to a more peaceful and charming retirement experience.

Contemplations of Jumbo Reverse Mortgage

Property Estimation:

Meeting all requirements for a jumbo reverse mortgage relies on the property’s evaluated esteem. Property holders should have a property that surpasses the cutoff laid out for Home Value Change Mortgages (HECMs). Banks might set a base property estimation as a feature of their qualification standards, and this edge can change among various loan specialists. The reasoning behind this thought is that jumbo reverse mortgages are intended for people with higher-esteem homes, and the credit sum is straightforwardly attached to the property’s assessed esteem.

Age Necessity:

Age assumes a critical part in deciding qualification for a jumbo reverse mortgage. By and large, borrowers should be no less than 62 years of age to qualify. The age of the borrower is a critical figure evaluating the credit sum, with more established borrowers possibly fitting the bill for a higher advance sum. This age prerequisite lines up with the more extensive idea of reverse mortgages, where property holders are utilizing the value developed in their homes over the long haul to help their monetary necessities during retirement.

Monetary Appraisal:

Banks might lead an intensive monetary evaluation of expected borrowers to guarantee they can meet their monetary commitments over the lifetime of the jumbo reverse mortgage. This evaluation includes the capacity to cover local charges, property holder’s protection, and general home upkeep costs. By assessing the borrower’s monetary dependability, moneylenders intend to relieve the gamble of default and guarantee that the borrower can capably deal with the continuous monetary obligations related with homeownership.

Loan costs and Expenses:

Planned borrowers ought to know that jumbo reverse mortgages might accompany higher financing costs and expenses contrasted with standard HECMs. It’s critical for people thinking about this monetary item to audit and analyze the related costs across various moneylenders cautiously. This incorporates understanding the design of loan fees, start expenses, shutting costs, and whatever other charges that might be relevant. An intensive assessment of these monetary perspectives guarantees that borrowers have a reasonable comprehension of the complete expense of the jumbo reverse mortgage and can go with informed choices in regards to its moderateness and appropriateness for their monetary circumstance.

Bottom Line

Jumbo reverse mortgages can be an important monetary device for seniors with high-esteem homes hoping to take advantage of their home value during retirement. While these credits offer expanded adaptability and admittance to additional significant assets, potential borrowers ought to painstakingly think about the qualification standards, monetary ramifications, and generally speaking reasonableness of a jumbo reverse mortgage for their singular conditions. Looking for exhortation from monetary experts and investigating different banks’ contributions can assist seniors with coming to informed conclusions about whether a jumbo reverse mortgage lines up with their retirement objectives and monetary necessities

FAQs

What is the essential contrast between a jumbo reverse mortgage and a standard reverse mortgage?

A jumbo reverse mortgage contrasts from a standard reverse mortgage as far as credit limits. While customary reverse mortgages, or Home Value Change Mortgages (HECMs), have governmentally settled limits, jumbo reverse mortgages take care of property holders with high-esteem properties that surpass these cutoff points. This key differentiation permits people with additional significant homes to get to a more prominent measure of value through a jumbo reverse mortgage.

How not set in stone for a jumbo reverse mortgage, and what are the principal rules?

Qualification for a jumbo reverse mortgage is normally resolved in light of elements, for example, property estimation, age of the borrower, and monetary dependability. Mortgage holders should have a property that outperforms the cutoff set for HECMs, and borrowers are for the most part expected to be no less than 62 years of age. Banks may likewise lead a monetary evaluation to guarantee that borrowers can meet continuous commitments, including local charges, protection, and home support.

What payout choices are accessible with a jumbo reverse mortgage, and how might they be redone to address individual issues?

Jumbo reverse mortgages offer a scope of payout choices, including a singular amount, credit extension, fixed regularly scheduled installments, or a blend of these. Borrowers have the adaptability to tailor the payout construction to their particular monetary objectives. For example, they can pick a single amount for guaranteed needs, a credit extension for future costs, or fixed regularly scheduled installments to enhance retirement pay. This customization enables seniors to adjust the jumbo reverse mortgage to their special monetary necessities and goals.