Navigating the Essentials of General Liability Insurance for Small Businesses

Post Preview

Key Takeaways

- General liability insurance is critical for small businesses to protect against risks.

- Understanding its mechanics, benefits, and nuances can save businesses from financial turmoil.

- Practical examples and straightforward advice will help demystify insurance jargon.

Table of Contents

- Introduction to General Liability Insurance

- Why Small Businesses Need General Liability Insurance

- Core Components and Coverage

- Common Misconceptions

- Tips for Choosing the Right Policy

- Real-Life Scenarios: What Could Go Wrong?

- Beyond General Liability: Other Essential Insurance Policies

- Final Thoughts on Securing Your Business

Introduction to General Liability Insurance

Navigating the dynamic and often unpredictable world of small business requires more than just a strategic plan and suitable products; it necessitates a robust risk management system. Foundational to this system is general liability insurance for small businesses, a vital safeguard poised to shield enterprises from unforeseen financial strain. It operates as a comprehensive financial safety net, allowing small business owners to continue operating with the full assurance that the shadow of potential legal or financial problems isn’t casting undue weight over daily operations.

The significance of general liability insurance extends beyond basic protections. It fundamentally transforms how businesses approach risk, empowering them to focus their efforts on fostering innovation, enhancing customer relationships, and scaling operations while enjoying the comfort of comprehensive protection against unexpected events and challenges. This insurance is not merely a precautionary measure; it’s an enabler of business growth and stability.

Why Small Businesses Need General Liability Insurance

Small businesses operate in a landscape where vulnerabilities abound, often intensified by limited resources and tight budgets. These businesses face unique challenges, from accidents occurring on-premises to minor contract disputes that may lead to more significant legal issues. The unpredictability inherent in these scenarios means that even minor incidents have the potential to escalate into significant financial burdens. Therefore, general liability insurance becomes a protective measure and a strategic investment in risk alleviation and operational continuity.

Such insurance provides many benefits, the paramount being financial protection from incidents that could halt business operations. It’s about ensuring that businesses can pay for the costs associated with accident-related medical expenses, cover legal defense fees, and settle claims adeptly without debilitating financial setbacks. This coverage thus provides peace of mind, allowing entrepreneurs to concentrate on advancing their business visions.

Core Components and Coverage

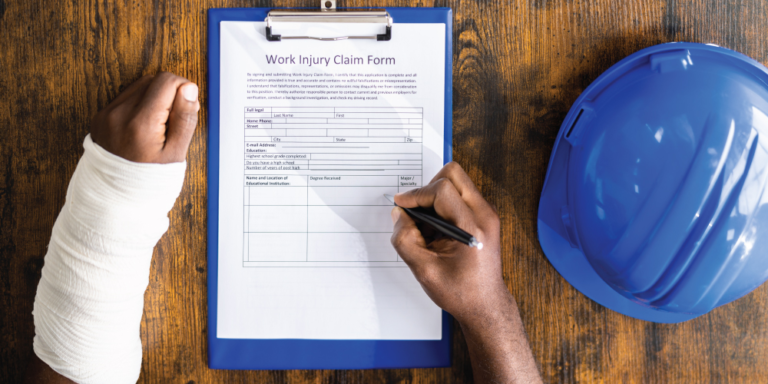

General liability insurance generally encompasses a wide-ranging suite of protections crucial for any business operation. Fundamental to this is coverage for bodily injuries and property damage that may occur due to business operations. For example, if a client trips over faulty flooring within a business premises and sustains injuries, the business could be held responsible for medical expenses. General liability insurance is designed to address such financial obligations effectively.

Beyond these fundamental areas, coverage typically includes protection against personal and advertising injuries, which are increasingly relevant in today’s interconnected and digital-focused economy. Such incidents might involve claims of slander, libel, or unauthorized use of a protected logo or image. By covering these areas, the insurance ensures that businesses can focus on creative and marketing endeavors without constant fear of legal repercussions or financial penalties. This broad coverage fosters a business environment that encourages growth and innovation.

Common Misconceptions

Despite the clear advantages and protective measures offered by general liability insurance, misconceptions often cloud its perceived value among business owners. A notable fallacy is the belief that only larger businesses require such insurance, leaving smaller entities perilously exposed to risks. As highlighted by Small Business Trends, dispelling these myths not only aids in better decision-making but also enhances strategic risk planning for entrepreneurs seeking sustainable growth.

Furthermore, there is a pervasive misunderstanding regarding the breadth of coverage offered by general liability insurance, leading some business owners to assume it covers all potential liabilities unequivocally. However, it is critical to understand the specific exclusions and limitations within a policy to ensure complete awareness of potential uncovered risks. Vetting and comprehending policy fine print can protect businesses from surprise liabilities and financial exposure.

Tips for Choosing the Right Policy

Choosing the ideal general liability policy is an exercise that requires thoughtful analysis and a nuanced understanding of specific business needs. A strategic starting point is to assess the particular risk landscape of your business, which entails acknowledging industry standards and identifying common challenges within your operational context. Learning from best practices among similar businesses and consulting with seasoned insurance professionals can provide invaluable guidance.

Once risks are clearly identified, it is vital to compare policy options. Pay close attention to coverage limits, deductible amounts, and unique features each policy offers. An informed choice is not solely based on cost but also the qualitative aspects of coverage, ensuring that a business is sufficiently safeguarded against plausible eventualities. An investment in the right policy pays dividends in resilience and stability over time.

Real-Life Scenarios: What Could Go Wrong?

The potential for real-world disasters underscores the importance of possessing comprehensive coverage. Consider scenarios where negligence or unexpected events injure or harm customers or clients. Such incidents can unravel rapidly, translating into arduous and costly legal claims. Forbes insights illustrate how businesses adeptly navigate these waters through robust insurance, emphasized by cases where insurance facilitated a resolution without sacrificing financial stability or business reputation.

These lessons from reality anchor the need for being well-prepared; businesses that anticipate and mitigate risks proactively often rebound more effectively, maintaining their course toward growth and innovation despite transient setbacks.

Beyond General Liability: Other Essential Insurance Policies

A holistic approach to insurance coverage goes beyond general liability insurance. Other insurance types, including professional liability insurance, which protects against negligence claims arising from professional services delivered, underscore comprehensiveness in protective measures. This type of insurance is particularly vital for service-oriented businesses where customer satisfaction and service delivery are paramount.

Additionally, workers’ compensation insurance is essential, providing coverage for workplace injuries, thus ensuring the well-being of employees and the business itself. When integrated with general liability coverage, these additional policies create a formidable shield that protects businesses from a comprehensive array of risks, enhancing long-term resilience and success.

Final Thoughts on Securing Your Business

Successfully steering a business toward sustained growth and innovation entails an astute recognition of potential hurdles and a proactive approach to risk management. When selected with insight and care, general liability insurance becomes an indispensable part of this strategy, offering security against unforeseen financial and legal challenges. By laying a strong foundation through strategic insurance planning, small businesses can ensure their endeavors remain resilient and primed for success amidst the evolving landscapes of risk and opportunity.

Also read: 55+Attitude Poetry